Welcome to the New Volunteer Information Page

Table of Contents

You are here because you have expressed an interest in volunteering for the Yolo County VITA/AARP/Tax-Aide program. My name is Jill Henes and I am the District Coordinator for Yolo County. I would like to tell you something about the program to help you decide if volunteering is right for you.

Introduction:

As you probably know, AARP/Tax-Aide provides tax preparation assistance for low and moderate-income taxpayers, with preference for those over 60. The tax preparation year runs from the beginning of February to April 15. We conduct training sessions in early January. This year the dates are not yet, set in stone but will most likely begin near the middle of the month. We will be sending out a schedule soon. Only a portion of the training is required, however, the training is strongly recommended. You can also cover the coursework on line. Several of our experienced volunteers are available in December and early January to give volunteers a chance to get used to the software and to ask questions. All these sessions are ordinarily scheduled by mid-November so you have plenty of time to work on the training materials. <Table of Contents>

Positions:

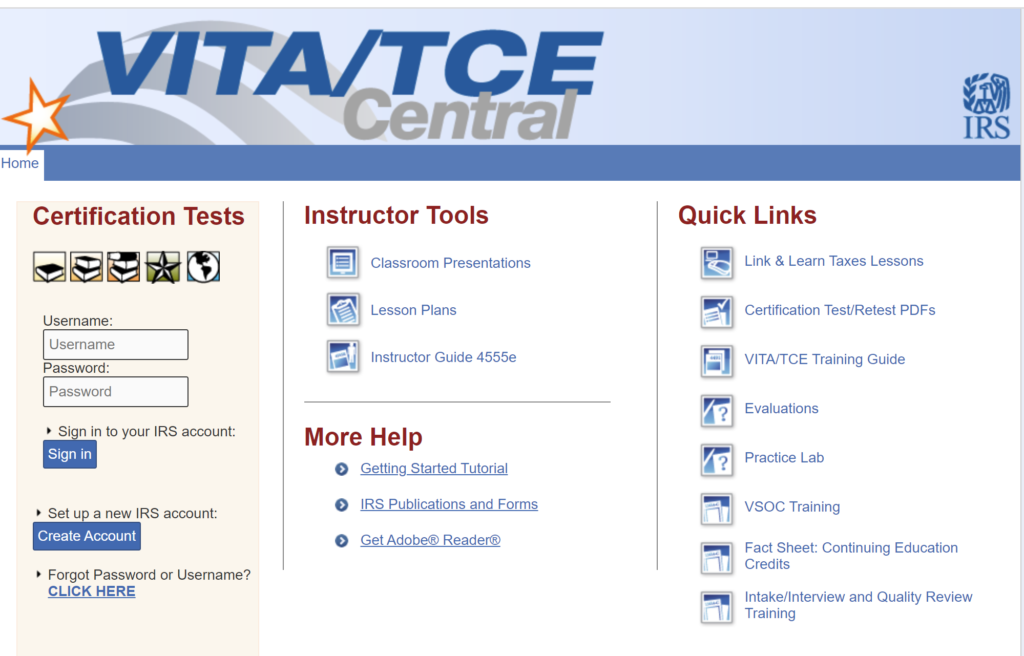

Volunteers who want to be counselors must pass an advanced certification exam before they can do tax preparation as counselors. The test is open book and must usually be completed by the end of the January training sessions, and no later than the beginning of the tax season. Printed course material will be available, but the entire course can be accessed – and the test can be taken – on the internet at the Link and Learn Website all year.

In addition to counselors, we also have opportunities for people who can act as facilitators. These people do not do the actual tax preparation, but help to manage the sessions by greeting clients, reviewing the material they have brought, assessing the complexity of the returns and placing the clients with counselors. This position does not require completion of the tax exam.

We are also looking for people with computer expertise to help prepare our laptop computers, networks, and printers, and to assist counselors when they have technical issues. We especially need volunteers who have the ability to create and maintain a simple webpage — yolotaxes.com. Another volunteer option involves mailing information to taxpayers who have set up their appointment slots. <Table of Contents>

Registration:

If any of this sounds good, it’s time for you to register to become a volunteer if you have not already done so.

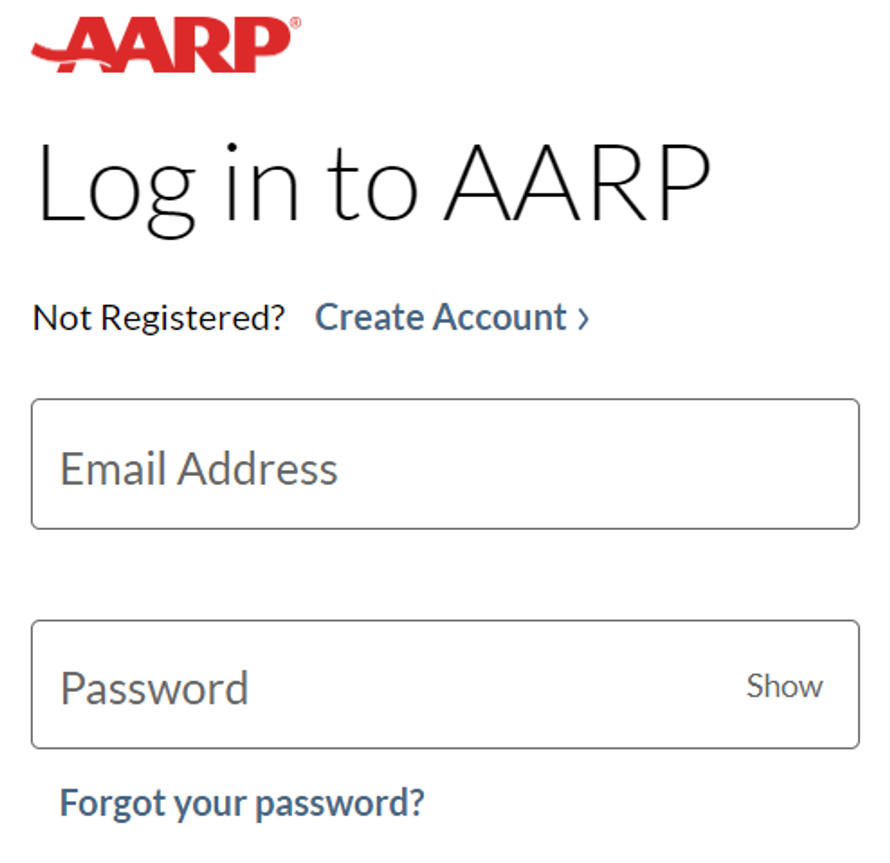

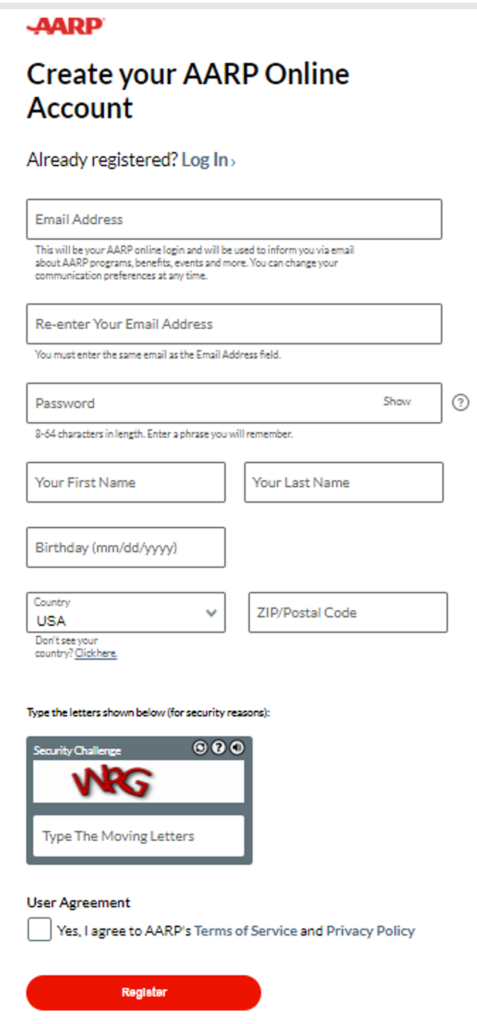

First, go to the website AARP.org and make an account. (You are not joining AARP.)

Log into your account then go to this website and fill in the application form: Tax-Aide Volunteer Page

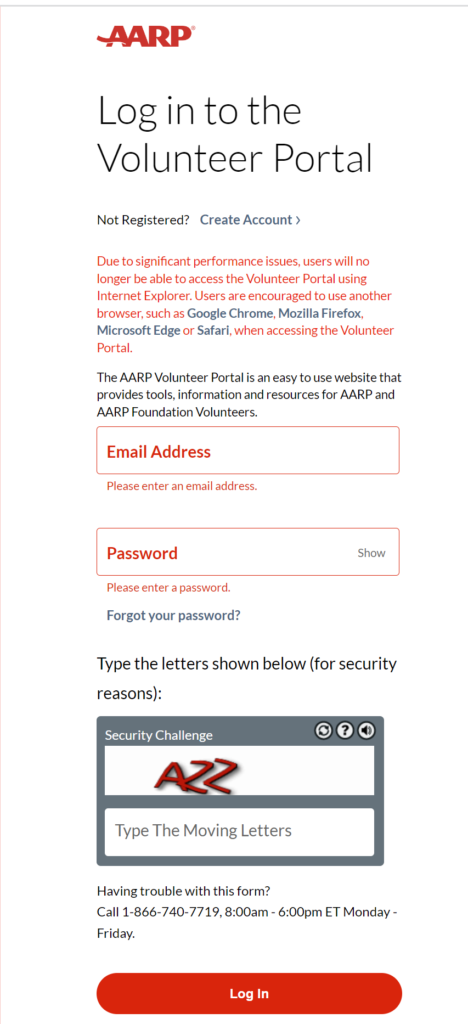

Once you are registered, I will send you an invitation to the Tax Aide Volunteer Portal where you can access reference and training materials in the library. After you have logged into the portal the first time, you can always reach the Volunteer Portal login from here. <Table of Contents>

Training:

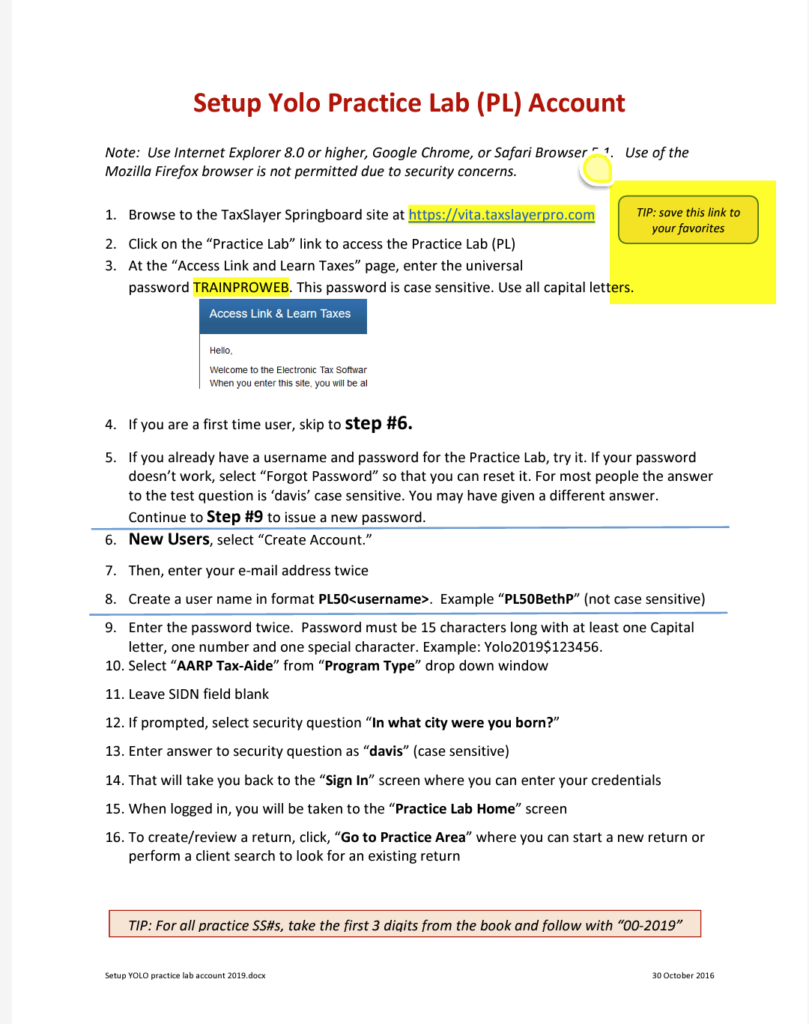

To prepare for the tests, we have materials and exercises for training. First, you need to sign into the TaxSlayer Practice Lab.

Use these resources as you do your practice problems to prepare for your certification exams.

The online versions of our 2025 Tax Year VITA training materials and the IRS version of the 4012 are now available.

*****NTTC TY25 Workbook – Practice Problems

This document contains practice problems to help you learn tax law and how to use the TaxSlayer software. It has a few corrections called Errata. <Table of Contents>

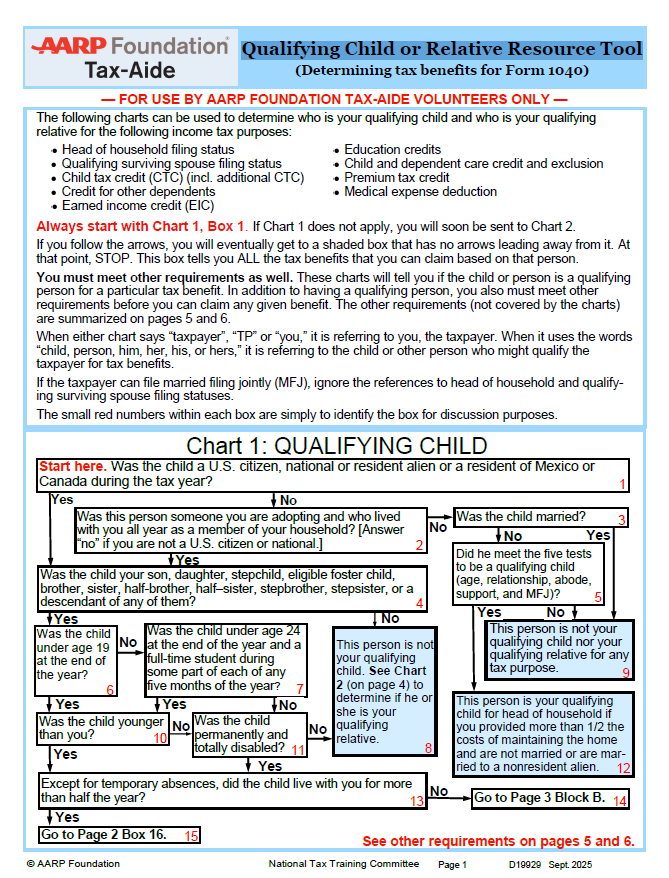

A useful tool in determining the eligibility of a person to be claimed as a dependent for the various tax credits is the Qualifying Child or Relative Resource Tool (Quad Fold)

These are the answers to the Core problems in the book.

*****IRS Volunteer Resource Guide – 4012

*****Volunteer Resource Guide – 2025 NTTC 4012 R1

This document explains how to enter various tax documents (such as w-2’s 1099’s etc) into the software TaxSlayer Pro and the Practice Lab. It is one of your best reference documents.

*****Volunteer Training Guide – 2025 NTTC 4491 R2

This document explains Tax Law.

This document tells us what we can and cannot do as tax preparers for AARP Tax-Aide – 2025 Scope V1.

*****2025 VITA Tax Law Certification Test Booklet – IRS Test Booklet

This document contains the Certification Tests.

*****Corrections to the Tax Law Certification Test Booklet

*****The California Counselor Reference Manual Feb 8, 2025 (Duckbook)

*****The 2024 VITA/TCE California Volunteer Reference Manual (CVRM)

Certification Requirements:

All volunteers must pass two tests on the Link & Learn website with 80% or better. The following documents will help you pass. The Link and Learn Website is not working yet.

*****The Volunteer Standards of Conduct Exam – Read the p4961 “Volunteer Standards of Conduct booklet”

*****The Intake/Interview & Quality Review Exam – Read the p5838 “Intake-Interview and Quality Review booklet”

Counselors must pass one additional test on the Link & Learn website with 80% or better.

Advanced Tax Law Exam – Study Tax Law (Publications 4012, 4199s the Duckbook and do Practice Problems.

All Volunteers must take two LMS courses on the Tax-Aide Volunteer Portal

Note: LMS courses are ready Now!.

Policy and Procedures

Technology & Security <Table of Contents>

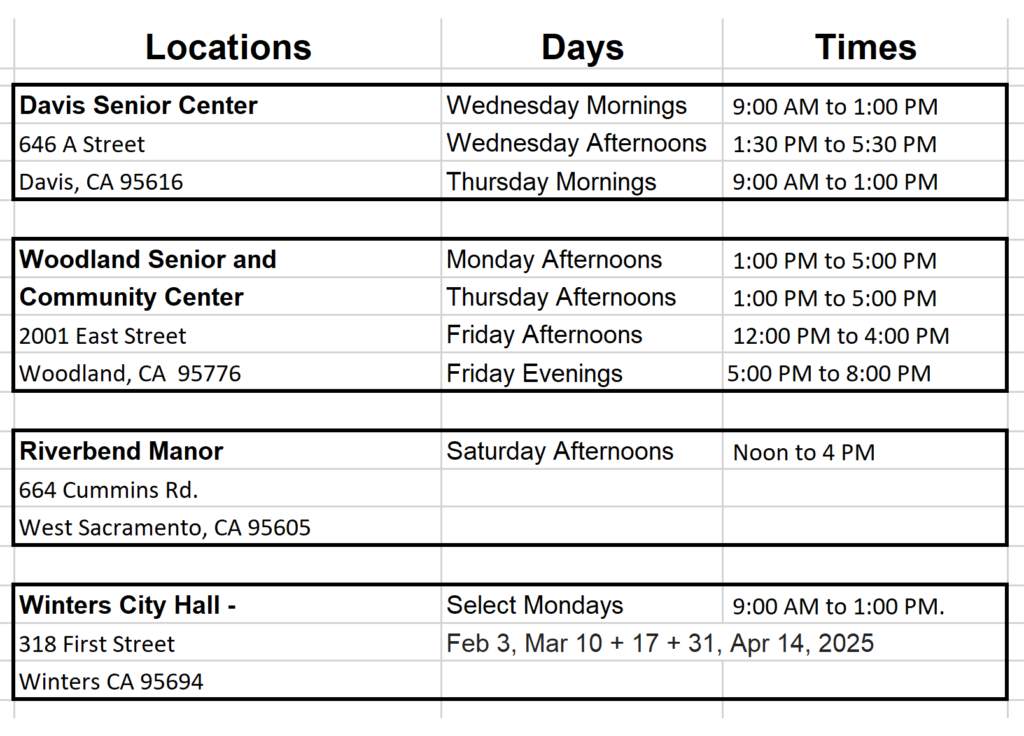

Sites:

Yolo County has several sites and sessions: (the days and times are tentative at this point and subject to change by us or our host sites) We start Tax Preparation the first week of February.

More Information:

Volunteers are asked to work at least 40 hours over the course of the tax season. Our sessions are filled by appointments that clients arrange by calling the various centers or appointment lines. Appointments last about one hour. A counselor typically sees 3 to 5 clients per session. Every return is double-checked by a quality reviewer. No return ever gets sent out without two certified counselors’ input. Our returns are prepared on AARP/Tax-Aide supplied Chomebooks using an IRS-supplied software program called TaxSlayer, and most are submitted electronically. Counselors should be comfortable working on a computer, be good with numbers, and be willing to guide taxpayers through the process. Experience preparing tax returns is helpful, but not required.

If you have any questions, please feel free to e-mail me (Jill Henes) at jillh2928@gmail.com) or call (530) 210-1070.

Thank you for volunteering! <Table of Contents>

Useful Links from VITA Training HERE